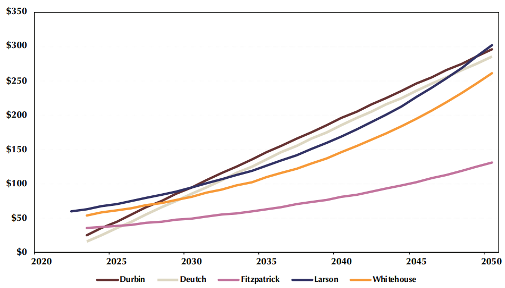

While several U.S. Congressional carbon legislations are circulating, one thing is quite certain: legislation of some sort will be enacted to incentivize a change in attitudes about global warming and decrease our carbon emissions in the near future through what amounts to a national carbon tax. Let’s break down the facts on the five legislations below.

America’s Clean Future Fund Act

Requirements: This legislation for carbon emissions regulations would start in 2025, placing a fee on noncovered fuel emissions equal to its expense rate for a given year.

Cost: $25 per metric ton of CO2 equivalent in 2023.

Inflation rate: The price per metric ton of CO2 will increase annually by $10, and the inflation fee will be rounded to the nearest dollar.

Projections: To stop carbon tax escalation rates from rising, emissions from covered fuels need to be 90% below the 2018 levels for three years.

Energy Innovation and Carbon Dividend Act

Requirements: While a start date has yet to be determined for this legislation, the adult monthly carbon dividend payments will be less than $20 for three consecutive years under this act.

Cost: $15 per metric ton of CO2 equivalent in 2021.

Inflation rate: The pricing is said to increase annually by $10 per metric ton. If the emissions reduction goal isn’t reached, the price will rise by an additional $15 per metric ton of emissions.

Projections: It was stated that the carbon fee escalation rate would be $0 once the covered fuels were below 90% of the 2010 levels.

MARKET CHOICE Act

Requirements: This plan will roll out in 2025 with an extra $4 per metric ton charged biennially if the total emissions exceed the emissions schedule.

Cost: $35 per metric ton of CO2 equivalent in 2023.

Inflation rate: Fees will increase annually at 5% beyond the CPI.

Projections: If you fail to pay your carbon tax for any given year as a covered individual, you are subject to a fine three times that of the original cost.

America Wins Act

Requirements: TDB

Cost: $59 per metric ton of CO2 range in 2022.

Inflation rate: The pricing will increase annually at 6% above the CPI.

Projections: TDB

Save Our Future Act

Requirements: This carbon emissions regulation contains additional fees for fluorinated gasses, methane, and other air pollutants. (No start date was provided.)

Cost: $54 per metric ton of CO2 equivalent in 2023.

Inflation rate: Pricing is said to increase annually 6% above the inflation rate.

Projections: By 2024, the criteria air pollutant fee will start at $6.30 per pound of NOX, $18.00 per pound of SOX, and $38.90 per pound of PM2.5.

What Will the Government Do with the Money?

Here’s where things get interesting! While each plan has similar pricing and goals, how the government uses the money from carbon legislation seems to vary. For example:

- Invest money into environmental efforts

- Give the money back to taxpayers

- Put money into infrastructure

Hence, the eventual plan adopted by the U.S. government will impact not only the carbon tax itself but the direction of the Treasury Department in spending these potentially huge revenues. For the full list of profit spending details per bill, click here.

How Can Your Business Prepare in Light of US Carbon Legislations?

Ready to learn more about ways your facility can save on energy costs? At NGS, we offer our clients energy modeling solutions to map out their problem areas and work to find, select, and install the ideal products to reduce your building’s potential for carbon taxes. Click here to read our latest blog on applying the reduce, reuse, recycle mantra to your business establishments.